Small business loans are like the magical beans of the entrepreneurial world—one minute you’re staring at your empty pockets, and the next you’ve got a beanstalk reaching up to the clouds of opportunity! With various types of loans sprouting everywhere, securing one is as important as remembering to water your plants—or at least your cash flow. So, buckle in as we dig into the nitty-gritty of small business loans, where we’ll not only break down the types and terms but also reveal how they can transform your business from ‘meh’ to ‘marvelous’!

From understanding the application process to mastering the art of risk management and crafting the perfect loan proposal presentation, we’ll cover it all. You’ll discover how to use your newfound funds to boost productivity, enhance sales, and maybe even give your business that extra push it needs to soar. So grab your notepad and let’s get ready to climb that beanstalk!

Small Business Loan Fundamentals

When diving into the whimsical world of small business loans, think of them as the magical potions that can transform your entrepreneurial dreams into reality. These loans come in various flavors, each tailored to suit different needs, from brewing up a café to launching the next tech sensation. Understanding the fundamentals of small business loans is your first step toward unlocking the treasure chest of funding options.The landscape of small business loans is as diverse as the pastries in a bakery.

Different types of loans fit various purposes and borrower profiles. The most common types include:

Types of Small Business Loans

It’s important to recognize the unique characteristics that accompany each type of loan. Below is a breakdown of some common types:

- SBA Loans: Backed by the Small Business Administration, these loans often come with lower interest rates and longer repayment terms, making them a popular choice for small business owners.

- Traditional Bank Loans: These are like the classic cars of loans—trusted but requiring a good credit score and solid collateral. They typically have lower interest rates but longer application processes.

- Online Business Loans: Quick and often less stringent than traditional bank loans, these can be funded in a flash—perfect for those urgent cash flow needs. However, they may come with higher interest rates.

- Merchant Cash Advances: Not a loan per se, but a cash advance based on future credit card sales. It’s like borrowing against your future success, but watch out for those fees!

- Equipment Financing: Designed specifically for purchasing equipment, this type of loan uses the equipment as collateral. If you need a shiny new printer or a pizza oven, this could be your ticket.

Understanding these types lays the groundwork for knowing which loan best fits your business model.

Application Process for Securing a Small Business Loan

Navigating the application process can sometimes feel like trying to solve a Rubik’s Cube blindfolded. However, with a clear sequence of steps, you can emerge victorious. Here’s a concise guide to the essentials of the application process:

- Research: Explore different loan options and lenders to find the best fit for your business needs and financial health.

- Prepare documentation: Gather necessary documents including tax returns, financial statements, and a solid business plan. Think of it as gathering your spell ingredients for the perfect potion.

- Fill out the application: Complete the lender’s application form with accurate and honest information. It’s like writing a love letter—be sincere!

- Submit and wait: After submitting your application, prepare for a waiting game. Use this time to perfect your business pitch, just in case they call!

- Loan offer evaluation: If approved, review the terms carefully. Ensure you’re comfortable with the interest rates and repayment terms.

As you navigate this process, remember that patience and preparation are your best allies.

Comparative Interest Rates and Terms Among Different Lenders

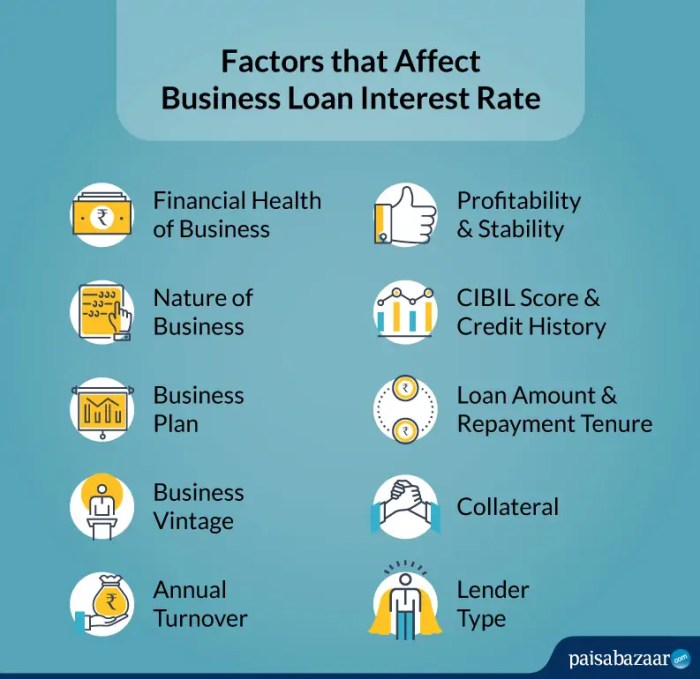

When it comes to interest rates and loan terms, shopping around is crucial—much like trying out different flavors at an ice cream shop. Here’s what to consider when comparing lenders:

- Interest Rates: These can vary significantly depending on the lender and your creditworthiness. Expect rates to range from 4% for SBA loans to upwards of 30% for less favorable terms.

- Loan Terms: Terms can range from a few months to 25 years, depending on the type of loan. Think long-term for capital investments and shorter for quick cash flow needs.

- Fees: Always check for any origination fees, application fees, and other hidden costs. After all, you don’t want to be surprised like finding a raisin in a cookie!

By comparing these essential factors, you’re better equipped to make an informed decision that nurtures your business growth without breaking the bank.

Impact on Business Productivity

In the world of small businesses, productivity is the name of the game. When you’ve got a great idea brewing and a vision that could conquer the world—if only you had the funds—small business loans come strutting in like a superhero in a shiny cape! They don’t just save the day; they boost productivity like a double espresso shot on a Monday morning.

With the right funds, small businesses can streamline operations, invest in technology, and ultimately keep the wheels of productivity turning with a bit more grease and a lot more gusto.Small business loans can significantly enhance overall business productivity by providing the necessary capital to improve various aspects of the operation. When funds are allocated wisely, businesses can upgrade their equipment, hire additional staff, or even invest in training programs.

These improvements lead to better efficiency, quicker service delivery, and an overall happier team—all of which translate to satisfied customers and improved bottom lines. Think of a well-oiled machine, where every cog turns just right; that’s what a small business can achieve with the right infusion of cash.

Effective Allocation of Loan Funds

Determining how to allocate loan funds effectively can be the difference between a small business thriving or just surviving. Here are a few savvy avenues to consider when it comes to spending that loan money wisely:Allocating funds to specific areas not only enhances productivity but also ensures that every penny is working as hard as you are. Here are some key areas that should be on your radar:

- Upgrading Technology: Investing in the latest technology can streamline processes and reduce the time spent on tasks. Think faster computers, better software, and those fancy cloud services that make everything a breeze.

- Employee Training: With new systems comes the need for training. A well-trained employee is like a well-trained dog; they’ll fetch you results faster than you can say “bark!”

- Marketing Initiatives: Funds spent on effective marketing can lead to increased customer engagement and sales. An eye-catching ad campaign could have clients flocking to your door like bees to honey.

- Inventory Management: Improving inventory systems can help track stock levels and reduce waste. After all, nobody likes a cluttered stockroom; it’s like finding a needle in a haystack, but without the charm!

- Operational Facilities: Enhancing working conditions through better facilities or workspace layouts can boost employee morale and productivity. Picture a clean, organized space vs. a cluttered desk—one sets the mood for success!

“Investing in the right areas is like planting seeds in a garden; with the right care, you’ll see growth blossom before your eyes.”

Successful examples of businesses that have upped their productivity game through loans abound. Take, for instance, a small bakery that used its loan to purchase a state-of-the-art oven. Not only did baking time decrease dramatically, but the quality of the pastries skyrocketed! Customers were lining up at the door, and the bakery’s profits soared faster than a soufflé in a hot oven.

Similarly, a tech startup utilized its loan to invest in cloud infrastructure, enabling their team to work from anywhere, which led to a more flexible and productive work environment. These examples showcase that with proper loan management and allocation, the sky is truly the limit for small businesses aiming for the stars.

Risk Management in Loan Acquisition

Navigating the winding roads of small business loans can feel like trying to find your way out of a maze blindfolded. As you embark on this adventure, it’s crucial to assess the risks lurking around every corner. Understanding risk management isn’t just a smart move; it’s an absolute must if you want your business to thrive without being devoured by the hungry jaws of debt.Assessing risk before applying for a loan is akin to checking your parachute before jumping out of a plane: you want to make sure you’ve got a backup plan in case things go wrong.

By evaluating potential risks, you can identify which loan options may come with a side of financial indigestion. This proactive approach allows you to better navigate the sometimes bumpy terrain of borrowing.

Strategies for Mitigating Financial Risks

When it comes to mitigating the risks associated with borrowing, knowledge is your best ally. Below are strategies that can safeguard your business’s finances while you secure that much-needed capital:

1. Understand Your Credit Score

Your credit score is like your financial report card. Before applying for a loan, pull your credit report, review it, and address any discrepancies. A higher score can help you snag a better interest rate.

2. Shop Around for Loan Options

Just as you wouldn’t buy the first pair of shoes you try on (unless they’re fabulous), don’t settle for the first loan offer. Compare terms, interest rates, and fees to ensure you’re not walking into a financial trap.

3. Create a Detailed Business Plan

A solid business plan acts like a GPS for your loan repayment journey, guiding your decisions and helping you forecast revenue to ensure you won’t be lost in the wilderness of debt.

4. Consider Alternative Funding Sources

If traditional loans seem too risky, venture into alternative funding avenues such as crowdfunding or microloans. This can sometimes mean lower risks and more flexible terms.

5. Build an Emergency Fund

Think of this as a financial safety net. An emergency fund can help you cover unexpected expenses or make loan payments during leaner months without breaking a sweat.

Checklist for Evaluating Loan Risks

When evaluating the potential risks of various loan options, a checklist can serve as your trusty companion, ensuring you don’t overlook any roadblocks. Below is a checklist that can help you assess the risks involved:

- Loan Amount: Is the amount you’re applying for appropriate for your business needs, or are you overreaching?

- Interest Rates: Are the interest rates competitive, or are you signing up for a financial rollercoaster ride with sky-high rates?

- Repayment Terms: Will the repayment terms fit your cash flow, or will they leave you gasping for air?

- Fees and Penalties: Are there hidden fees that could sneak up on you like a ninja in the night?

- Lender Reputation: Does the lender have a solid reputation, or are they known for pulling fast ones on unsuspecting borrowers?

- Flexibility of Terms: Can the loan terms adapt to your business’s needs, or are you locked in like a contestant on a game show?

- Impact on Cash Flow: Have you analyzed how the loan will affect your monthly cash flow, or are you just winging it?

“Failing to plan is planning to fail.”

Alan Lakein

Being proactive and thorough in your assessments can help you avoid the pitfalls often associated with small business loans. Remember, a well-prepared borrower is a confident borrower!

Business Presentation for Loan Proposals

Creating an effective business presentation for loan proposals is like preparing a sumptuous meal for discerning diners. You want to showcase your business’s finest ingredients while ensuring that your financial stew doesn’t leave the lender feeling queasy. The right presentation can be the difference between securing that life-changing loan and having your dreams tossed into the trash bin.A well-structured presentation should clearly highlight the essential elements that convince lenders they’re making a wise investment.

This includes an overview of the business, its financial needs, and how the loan will translate into growth and productivity. But remember, every lender has their unique palate, so tailoring your presentation to meet their expectations is essential for success.

Key Elements to Include in a Business Presentation

To keep your audience engaged and eager to invest, it’s crucial to include the following key elements in your presentation:

- Business Overview: Start with a concise introduction to your business, including its mission, vision, and unique selling propositions. Think of this as the appetizer – it should be enticing and set the stage for the main course.

- Market Analysis: Present data on industry trends, target demographics, and competitive analysis. This is akin to showcasing your farm-to-table sourcing; it demonstrates that you know your market inside and out.

- Financial Projections: Include detailed financial forecasts including profit and loss statements, cash flow projections, and balance sheets. This savory slice of pie shows lenders how you plan to grow the business and repay their investment.

- Loan Utilization: Clearly Artikel how the loan funds will be used. Whether it’s for inventory, equipment, or hiring, lenders want to know their money will be well-spent. Serve them a delicious dish of clarity and purpose.

- Risk Management: Address potential risks and your strategies to mitigate them. Think of this as your ‘insurance policy’ – even the finest meals can have a few unexpected ingredients, so show you’re prepared.

Tailoring Presentations Based on Lender Expectations

Understanding your lender’s preferences is crucial for a successful pitch. Different lenders prioritize different aspects of your business, so customize your approach accordingly. For instance, a bank might focus on financial stability and credit history, while a venture capitalist might be more interested in the growth potential and innovative aspects of your business model.

- Research the Lender: Before creating your presentation, study the lender’s history, sector interests, and any previous investments. Personalize your pitch as if you were writing a love letter – show them you know them well.

- Highlight Relevant Success Stories: If you know the lender has invested in similar businesses, mention those successes. This builds credibility and shows you’re part of a winning team.

- Speak Their Language: Use terminology that resonates with the lender. For example, if they value sustainability, emphasize your eco-friendly practices.

Methods for Effectively Communicating Business Plans

The art of communication is not just about what you say, but how you say it. Here are some methods to effectively present your business plan and financial needs:

- Engaging Visuals: Use clear graphs, charts, and infographics to visually represent your data. A well-designed slide is like a beautifully plated dish – it makes the information more appetizing and easier to digest.

- Storytelling: Weave a compelling narrative around your business journey. Share your challenges, triumphs, and future aspirations. This personal touch can create an emotional connection, making your proposal more memorable.

- Practice, Practice, Practice: Rehearse your presentation multiple times to ensure smooth delivery. A well-rehearsed pitch reflects confidence and professionalism, akin to a chef perfectly executing a recipe.

- Seek Feedback: Before the big day, present your proposal to a trusted mentor or colleague. Fresh eyes can spot areas for improvement and help refine your presentation to perfection.

“A well-crafted presentation is your golden ticket – it opens doors, ignites interest, and paves the way for financial success!”

Sales Management and Loan Utilization

When it comes to small businesses, finding ways to enhance sales efforts can feel like searching for a needle in a haystack—if that needle were also made of spaghetti and the hay was a mountain of bills. Fortunately, small business loans can be the golden ticket that transforms your sales woes into sales wows. With some strategic thinking, you can leverage these funds to supercharge your sales team and, ultimately, your bottom line.Small business loans can be utilized in various innovative ways to enhance sales efforts.

For instance, investing in marketing campaigns, upgrading technology, or expanding inventory can create a ripple effect that boosts sales. Picture this: with a loan, you can finally afford that snazzy new point-of-sale system that not only tracks sales but also entertains customers with dad jokes while they wait. Here are some key areas where loan funds can make a significant impact:

Building a Sales Team That Maximizes Loan Funds

Creating a sales team that fully capitalizes on loan resources requires some serious strategizing. A well-structured sales team can effectively convert potential leads into loyal customers, increasing sales performance metrics dramatically. Here are a few strategies to consider:

1. Invest in Training and Development

Allocate a portion of the loan for comprehensive sales training. This means your team can develop skills in negotiation, closing deals, and, most importantly, how to handle customer objections without resorting to interpretive dance.

2. Upgrade Technology and Tools

Use loan funds to equip your team with the latest sales software and tools. Imagine enabling them to track leads faster than you can say “ROI.” With better tools, your team can focus on selling rather than playing hide and seek with spreadsheets.

3. Streamline Communication

Implement communication platforms that facilitate collaboration among sales team members. Funds from the loan can help set up systems that allow your team to share leads and success stories, creating a culture of motivation and friendly competition.

4. Enhance Marketing Efforts

Combine your sales strategies with robust marketing initiatives. By leveraging loan funds to run targeted ad campaigns or social media promotions, your sales team can have a steady flow of leads to convert—like turning water into wine—but, you know, legally.

5. Incentivize Performance

Use a portion of the loan to create performance-based bonuses. This way, your team will be motivated to hit targets, leading to that sweet, sweet sales performance metric improvement. Who doesn’t want to turn a boring office into a party zone when sales goals are met?Once the initiatives funded by the loan are in motion, the implications on sales performance metrics will become evident.

Tracking these metrics is crucial as they will reveal the effectiveness of your loan-funded strategies. Key performance indicators (KPIs) include:

Sales Growth Rate

Measure the increase in sales over a specific period to gauge the impact of your investments.

Conversion Rates

Evaluate how many leads are turning into actual sales, helping you understand the effectiveness of your sales team.

Customer Acquisition Cost (CAC)

Assess the cost-effectiveness of obtaining new customers, especially after implementing new tools and training.

Average Deal Size

Determine if the average value of sales has increased, indicating that your enhanced strategies are working.By keeping a close watch on these metrics, small businesses can ensure that their loan investments are not just a shot in the dark, but a well-aimed arrow hitting the target of increased sales and productivity. With these strategies in play, small business owners can sit back, relax, and let the sales roll in—preferably with a side of celebratory pizza!

Final Review

In conclusion, small business loans are not just about cashing a check; they’re about fueling your vision and igniting dreams! With the right knowledge and strategies, you can navigate the loan landscape like a pro, transforming potential pitfalls into stepping stones. So whether you’re looking to expand, enhance productivity, or build a sales team that sells like hotcakes, remember that the right loan can make all the difference.

Now, go forth and conquer that loan game like the savvy entrepreneur you are!

Q&A

What types of small business loans are available?

There are several types, including term loans, lines of credit, and SBA loans, each with unique benefits and requirements.

How long does the loan application process take?

This can vary widely, from a few days to several weeks, depending on the lender and the complexity of your application.

Do I need collateral for a small business loan?

It depends on the type of loan; some require collateral, while others, like unsecured loans, do not.

Can I get a small business loan with bad credit?

It’s challenging, but some lenders specialize in working with businesses that have less-than-stellar credit histories.

What’s the best way to use a small business loan?

It varies by business, but common uses include purchasing equipment, hiring staff, or increasing inventory to boost sales.